A Look at T. Rowe Price’s Glide Path Changes

January 9, 2021

SUMMARY

T. Rowe Price is making material changes to the glide path of its Retirement series of target date funds

The changes will result in a more aggressive approach, with higher allocations to equities at most points along the glide path

We suggest that investment committees:

Review the Retirement series, including the new glide path and the reasoning behind the changes

Compare the series’ approach to that of peers

Either

Document the determination that the Retirement funds are prudent options for the plans’ participants; or

Initiate a search for a replacement series

A MORE AGGRESSIVE GLIDEPATH

The “glide path” is the process by which a target date fund’s allocation changes over time, from a more aggressive allocation early in a participant’s employment cycle to a more moderate allocation near and in retirement.

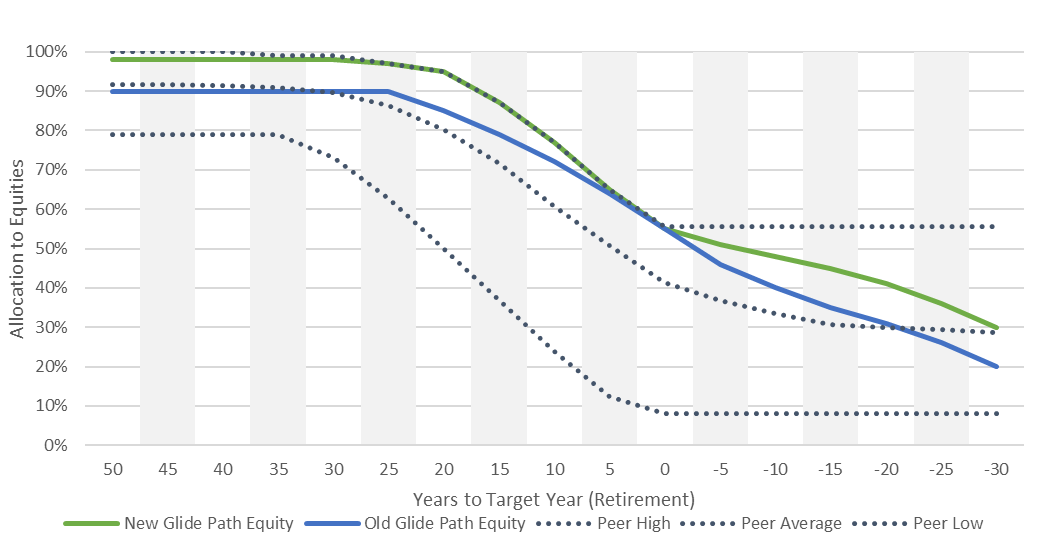

Already one of the most aggressive target date series, T. Rowe Price is increasing the equity allocation at both the early and later ends of the Retirement series glide path.

New vs. Old Equity Allocations, Years from Retirement Date

Compared to peer averages, the glide path of the “old” Retirement series most heavily overweighted equities in the years immediately leading to and following retirement. The new glide path weights equities more heavily throughout the series’ life cycle.

The glide path modification will be gradually implemented over approximately two years, beginning in April 2020.

New vs. Old Glide Path

THE REASONING BEHIND THE CHANGE

The results of a two-year review have amplified T. Rowe Price’s historical belief that the most significant risk retirement savers face is running out of money in retirement, and that a higher equity allocation is the best solution:

“Increasing the level of equity pre-retirement allows those investors with the longest time horizon to benefit from the potential compounding effects of the additional growth-seeking assets” (meaning equity)

“A modest increase in growth-seeking assets post-retirement may help generate income and replace consumption spending in retirement”

“…raising equity levels led to higher balances in retirement, more sustainable withdrawals, and greater residual wealth”

In addition, management believes that participants who use target date funds are less likely to make investment changes during equity downturns than are other participants.

T. ROWE PRICE RETIREMENT SERIES OVERVIEW

Strategic Glide Path

T. Rowe Price believes that retirees' most significant risk is outliving their savings. In 2020, the relatively aggressive equity glide path has been made even more so, allocating as much as 16 percentage points more in equities than the peer average. Beginning with a 98% equity stake, the funds reach a target allocation of 55% equity at retirement and then continue to shift for 30 more years until the equity stake plateaus at 30%.

Tactical Asset Allocation

The managers have modest leeway to adjust the funds' stock/bond split (by up to 5 percentage points) and make sub-asset-class tilts, such favoring growth over value stocks. A committee of veteran T. Rowe Price managers relies primarily on qualitative insights to determine which asset classes to emphasize for the next six to 18 months.

Sub-Asset Class Allocation

Within the major headings of stock and bond, strategic sub-asset class allocations remain static through the glide path; however, they are widely diversified.

Underlying Strategies

The funds underlying the series’ allocation are all proprietary investments managed by T. Rowe Price. The series' managers generally remain hands-off in monitoring the underlying funds, allowing the firm's leaders to address any issues; the managers have rarely removed a fund since its 2002 inception. Nearly all the series underlying funds are actively managed, with over 80% of the series allocation invested in active strategies.

Management Changes

In addition to glide path modifications, the T. Rowe series is in the midst of another change. Lead manager Jerome Clark will relinquish his portfolio management duties at the beginning of 2021. Kim DeDominicis and Andrew Jacobs van Merlen join Wyatt Lee on the roster. DeDominicis has served as an associate portfolio manager on the funds since 2015, and Jacobs van Merlen has supported the firm’s target-risk strategies. Both have over 20 years of investment experience at T. Rowe.

Clark participated in the development of the firm’s target date efforts and has served as the lead manager since the Retirement series’ 2002 inception. His transition has been long-planned and well-communicated. The remaining team is supported by the firm's multi-asset group, which now numbers about 25, and T. Rowe Price’s asset allocation committee.

FOR INSTITUTIONAL USE ONLY

Vergence Institutional Partners LLC is registered as an investment adviser with MA, MI, RI, and TN. Vergence Institutional Partners LLC only transacts business in states where it is properly registered or is excluded or exempted from registration requirements.

This report is a publication of Vergence Institutional Partners LLC. Information presented is believed to be factual and up to date, but we do not guarantee its accuracy, and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change.

Information contained herein does not involve the rendering of personalized investment advice but is limited to the dissemination of general information. A professional adviser should be consulted before implementing any of the strategies or options presented.

Information is not an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein.

Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy (including the investments or investment strategies recommended by the adviser), or product made reference to directly or indirectly, will be profitable or equal to past performance levels.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for a client's investment portfolio.

Historical performance results for investment indexes or categories generally do not reflect the deduction of transaction and custodial charges or the deduction of an investment-management fee, the incurrence of which would have the effect of decreasing historical performance results. You cannot invest directly in an index.

Economic factors, market conditions, and investment strategies will affect the performance of any portfolio, and there are no assurances that it will match or outperform any particular benchmark.

Vergence Institutional Partners LLC does not provide legal advice. The information herein is general and educational in nature and should not be considered legal advice.

20210331TLDTLD0019

© 2021 Vergence Institutional Partners LLC