401(k) litigation and the root of fiduciary risk

October 25, 2019

Prudent, consistently followed processes are keys to limiting fiduciary exposure. Those fiduciaries who neglect their duties can find themselves on the receiving end of a lawsuit. In this article, we look at the bases for over a decade of 401(k) litigation, examine the root causes, and discuss how investment committees can keep to the prudent path.

401(k) suits: How many and why?

In May of 2018, the Center for Retirement Research at Boston College (CRR) released a paper called “401(k) Lawsuits: What Are the Causes and the Consequences?”.[i] The paper examined the scale of litigation against 401(k) plans between 2006 and 2017, the basis for that litigation, and the changes that litigation has caused in sponsor behavior and plan design. Though the paper focuses on 401(k) plans, we believe that the observations could safely be extended to other ERISA-governed defined contribution plans as well as non-ERISA plans that are subject to similar expectations of fiduciary conduct.

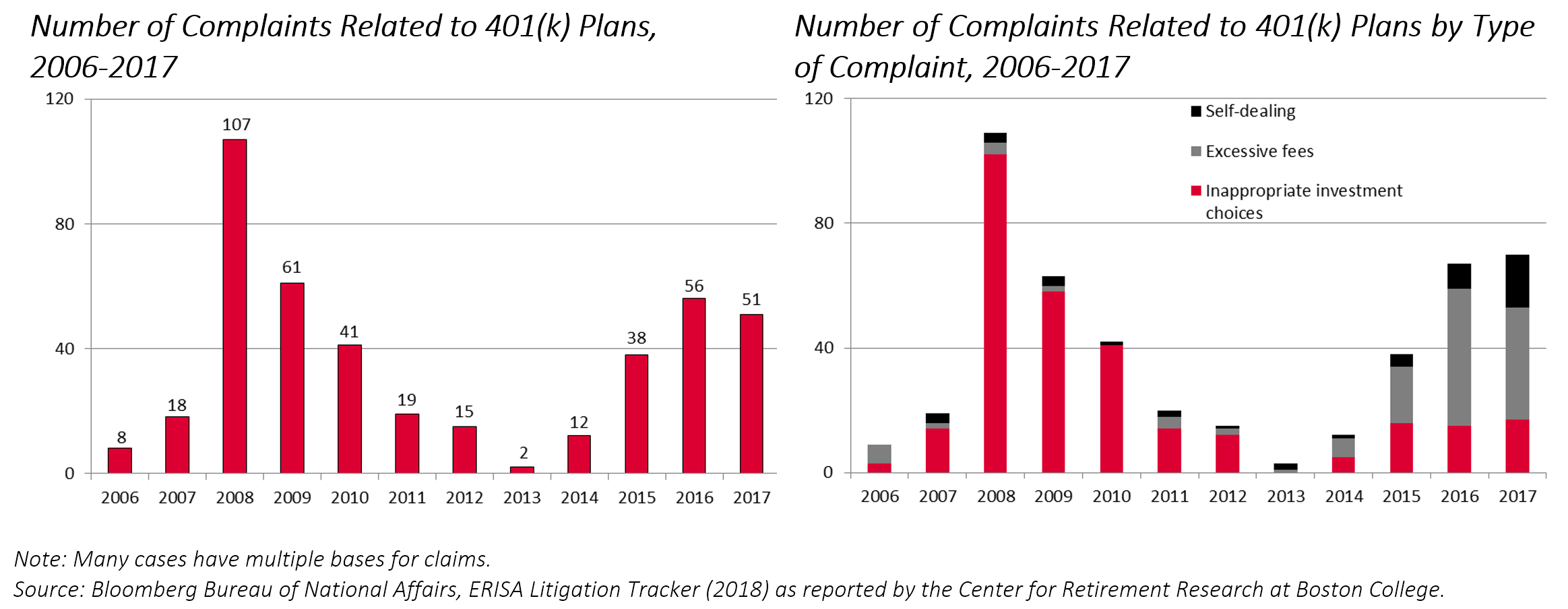

The authors found that the basis for claims in litigation brought against plan sponsors generally fell in one or more of three basic categories:

1. Inappropriate investment choices

The brief’s “inappropriate investment choices“ category counted complaints that included “employer stock investment losses,” “selection and monitoring of investment advisers/managers,” and/or “subprime mortgage-related investment losses” as a basis.

2. Excessive fees

The “excessive fees” category counted complaints that included “excessive or unreasonable 401(k) plan fees” as a basis. Both investment and administrative fees were considered.

3. Self-dealing

The authors counted complaints that included “proprietary mutual fund(s) investments” as a basis. In general, “self-dealing” in an ERISA environment involves a fiduciary placing its own interest above the interests of the plan and its participants.

Within the data are obvious trends. During the financial crisis of 2007-2009, there was a significant leap in the total number of complaints, with much of the litigation based on inappropriate investment choices. This makes intuitive sense, given the fallout of the crisis on stock prices (most relevantly, the impact on company stock funds) and on investments with holdings in sub-prime mortgages (including “yield-enhanced” short-term funds, stable value funds, and securities lending programs). Building in 2014 and after was a focus on excessive fees (mirrored in the 403(b) world) as well as self-dealing.

ERISA’S EXPECTATIONS

Regarding investments: ERISA imposes the “Prudent Man Standard of Care”.[ii] Fiduciaries are expected to act “with the care, skill, prudence, and diligence under the circumstances then prevailing that a prudent man acting in a like capacity and familiar with such matters would use”. The standard places preeminence on the process used to select an investment more than on the investment, itself. As the authors put it so well, “Two fiduciaries could choose the same investment option and face different risks of liability if one followed a prudent decision-making and monitoring process – for example, by considering the performance and costs of relevant benchmarks – and the other did not.”[iii]

Regarding fees: Just as ERISA doesn’t explicitly dictate what makes an investment prudent or imprudent, neither does it provide specific guidance on what makes a fee reasonable or excessive. Rather, ERISA indicates that fiduciaries must follow a prudent process to ensure that a plan pays only reasonable fees for necessary services. This obligation is ongoing; it doesn’t stop at the selection of a provider or investment. As such, a fiduciary’s assessment of the value of particular services or investments and their costs should be consistent, ongoing, and regular.

Regarding self-dealing: ERISA prescribes that “a fiduciary shall discharge his duties with respect to a plan solely in the interest of the participants and beneficiaries”.[iv] Recent self-dealing litigation has most frequently involved plan sponsors in the asset management industry who offered their own funds to their employees as investment options in their own 401(k) plans. While the record of success for such litigation is mixed, it’s reasonable to expect that an investment manager placing their own products in their own retirement plan could, at some point, face scrutiny for doing so. Such situations place even bolder emphasis on the need for sponsors to have in place prudent, consistently followed processes for investment and provider selection, as well as regular assessments of fiduciary exposure.

It all comes down to process

Now that this data has been presented so well by the CRR, what’s the lesson for sponsors interested in avoiding becoming a statistic? It boils down to process. Regardless of the categorization used to describe the nature of litigation, the source of exposure in most complaints can be found in a failure to have and/or follow prudent policies, procedures, and practices. While nothing can be done that will guarantee you’ll avoid litigation, putting ERISA’s guidance into specific practice may keep you in a position to weather the possibility:

People: Set up a formal investment committee. Ensure that members are “familiar with such matters”[v] and able to meet the Prudent Man standard (basic training can be helpful). Create a committee charter so that all members understand the duties and expectations of committee membership. Get the help of a capable consultant and, when necessary, outside counsel. Good consultants and lawyers may add to your budget, but sound advice is usually a cost-saver in the long run.

Policy: Document a formal Investment Policy Statement, then ensure that you follow it. A good policy will provide meaningful guidance while avoiding language that can trap the committee into actions that run counter to participant interests. Make certain that the policy fits your organization; it can be worse to have a policy that isn’t followed than it is to have no policy at all.

Process: Conduct a regular schedule of meetings to monitor your plan and its investments. Document your meetings with minutes. Ensure adherence to your Investment Policy and Committee Charter.

Investments: Compare investment performance to appropriate peer groups and benchmarks. Benchmark investment expenses to appropriate peers no less than annually and be aware of all share class and vehicle options available to your plan. Conduct investment manager searches in accordance with your investment policy and document your decisions. Ensure that all committee members understand each of the plan’s investments, including target date options.

Providers: Regularly review providers to ensure that they’re performing in accordance with their service agreements. Benchmark the costs and services of administrative and managed account providers on a periodic basis to ensure that expenses are reasonable and that services are competitive and meet the needs of your participants. Ensure that committee members understand your managed account product, and review participant data on a regular basis.

In Conclusion

It can be easy to get distracted. Benefits managers and committee members have multiple responsibilities and there’s only so much time in the day. Creating and adhering to a prudent process isn’t nearly as exciting as discussing capital markets or trying to wring out a few extra basis points of return (or maybe it is?). However, while being a good fiduciary isn’t easy, there’s no reason for an investment committee to be its own worst enemy. Formulating, documenting, and following prudent policies and processes, maintaining a competent, interested investment committee, and keeping focus on what has a material impact on participant success will go a long way to avoiding problems, legal and otherwise, down the road.

Closing note: Mr. Spinks also said “I got hit a lot. I'm glad I lived through it.” – a sentiment with which sponsors on the receiving end of litigation can likely identify!

[i] Mellman, George S., and Geoffrey T. Sanzenbacher. 401(k) Lawsuits: What Are the Causes and the Consequences? Center for Retirement Research at Boston College, May 2018, crr.bc.edu/briefs/401k-lawsuits-what-are-the-causes-and-consequences/.

[ii] ERISA § 404(a)(1).

[iii] Mellman, 401(k) Lawsuits, 2

[iv] Same ERISA citing as above.

[v] Same ERISA citing as above.

FOR INSTITUTIONAL USE ONLY

Vergence Institutional Partners LLC is registered as an investment adviser with the states of KY, MA, MI, RI, and TN. Vergence Institutional Partners LLC only transacts business in states where it is properly registered or is excluded or exempted from registration requirements.

This report is a publication of Vergence Institutional Partners LLC. It is intended only for use by plan sponsors and fiduciaries. Information presented is believed to be factual and up to date, but we do not guarantee its accuracy, and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change.

Information contained herein does not involve the rendering of personalized investment advice but is limited to the dissemination of general information. A professional adviser should be consulted before implementing any of the strategies or options presented.

Vergence Institutional Partners LLC does not provide advisory services to individuals.

Vergence Institutional Partners LLC does not provide legal or tax advice. Please consult your tax or legal advisor to address your specific circumstances.

Information is not an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein.

Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy (including the investments or investment strategies recommended by the adviser), or product made reference to directly or indirectly, will be profitable or equal to past performance levels.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for a client's investment portfolio.

Historical performance results for investment indexes or categories generally do not reflect the deduction of transaction and custodial charges or the deduction of an investment-management fee, the incurrence of which would have the effect of decreasing historical performance results. You cannot invest directly in an index.

Economic factors, market conditions, and investment strategies will affect the performance of any portfolio, and there are no assurances that it will match or outperform any particular benchmark.

20191022TLDTLD0007

© 2019 Vergence Institutional Partners LLC